Table of Contents

1. Definition of Taxi Business

2. Driver GST/HST Registration

3. Collection and Remittance of Net Tax

3.1. The GST/HST Collected

3.1.1. Calculation of the GST/HST Collected

Example 1

Example 2

3.1.2. Invoice / Receipt Presentation

3.2. The GST/HST Paid

3.2.1. GST/HST Paid on the Purchase of the Vehicle

3.2.1.1. When using the vehicle 90% or more for ride sharing

Example 3

3.2.1.2. When using the vehicle less than 90%, but more than 10%, for ride sharing business

Example 4

3.2.1.3. When using the vehicle less than 10% for ride sharing business

3.2.2. GST/HST Paid on Operating Expenses

4. Change of Use of Personal Capital Property

Example 5

5. Audits and Records Retention

CRA Reference Materials

This article provides the comprehensive GST/HST guidelines and requirements for “self-employed” commercial ride-sharing drivers and taxi drivers. It covers GST/HST requirements for starting the business, running the business, and leaving the ride-sharing business. For more information or inquiries kindly reach out to us at insights@dominionaudit.com or at info@dominionaudit.com.

1. Definition of Taxi Business

The Excise Tax Act (ETA) defines

taxi business as: a business of transporting passengers for commercial

activity by taxi for fares, that are regulated by federal or provincial

laws, and persons carrying on a business of transporting passengers for commercial

activity for fares by motor vehicle, within a municipality and its environs,

if the transportation is arranged or coordinated through an electronic platform

or system, such as a mobile application or website. A taxi business also

includes limousine services, even if they are not metered. For example, a

limousine service at an hourly rate that is not metered is considered a taxi

business. Examples of amounts charged in the taxi business include:

§

metered taxi and limousine

fares.

§

flat-rate fares charged for

transporting passengers by taxi and limousine.

§

fees charged for leasing a taxi

vehicle to a driver;

§

fees charged by taxi

licence owners for the use of their taxi licence.

§

dispatch fees charged by a

taxi stand to a driver, and

§ related charges such as waiting time, parcel delivery, and transportation of luggage.

2. Driver GST/HST Registration

For the purposes of GST/HST, and

QST, entities that are either eligible or mandated to register, depending on

the situation, encompass all "persons". The legislation characterizes

a person as an individual, partnership, corporation, trust or estate, or an

entity that functions as a society, union, club, association, commission, or

any other type of organization.

The legislation specifies that an

individual is defined as a "natural person". Consequently, an

individual intending to engage in one or more commercial activities, such as

ridesharing and taxi services, as a sole proprietor is classified as a person

obligated to register for GST/HST, and QST. This requirement holds true

regardless of the number of distinct businesses operated by the sole

proprietor, unless the person qualifies as a "small supplier".

A small supplier engaged in

providing taxable commercial ride-sharing services, along with other taxable

supplies, typically holds a registration that pertains solely to their

commercial ride-sharing services unless they indicate otherwise. Consequently,

self-employed commercial ride-sharing drivers are not obligated to charge

GST/HST for other taxable supplies, nor can they claim input tax credits (ITCs)

or input tax refunds (ITRs) related to those supplies (ITCs and ITRs will be

elaborated on later in this publication).

Should the total annual revenue from taxable supplies of commercial ride-sharing services and other taxable supplies surpass $30,000 (for instance, $20,000 from commercial ride-sharing services and $15,000 from other taxable supplies), the self-employed commercial ride-sharing driver ceases to be classified as a small supplier and must charge and collect tax on all sales derived from their taxable supplies (the total taxable supplies amounting to $35,000). If a self-employed commercial ride-sharing driver was already registered for GST/HST, including for another commercial activity, they are automatically deemed registered concerning their commercial ride-sharing services and are not required to reapply for registration.

3. Collection and Remittance of Net Tax

Every person (as defined by the

ETA) that provides a taxable supply in Canada, or in Québec for QST purposes,

is obligated, as an agent of the government, to collect the GST/HST, or QST,

that is owed by the recipient concerning the supply. The ETA stipulates that a

person who is mandated to register for GST/HST and has not done so is still bound

to the general tax collection obligations set out in the ETA and, therefore, is

subject to the same regulations and enforcement measures as those who are

registered. The Act respecting the Québec sales tax (QSTA) mandates the same

for QST purposes.

For any GST/HST, or QST, registrant, the sales tax should be classified in their books as sales tax collected and sales tax paid. This is because each is treated differently from accounting and tax legislation perspective.

3.1.

The GST/HST Collected

3.1.1.

Calculation of the GST/HST

Collected

In the taxi industry, when the

GST/HST is not itemized on a separate line of the invoice, it is considered to

be incorporated into the fares. Consequently, the registrant is required to

determine the amount of GST/HST that is part of the fares.

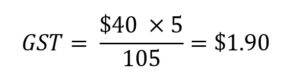

For example, if the registrant's fares encompass the GST, the registrant should multiply the invoice total by 5 and divide the outcome by 105. The following is a numerical example.

Example 1

A taxi driver working in Alberta charges a $40 fare for a trip from an airport to a hotel. No GST was shown after the receipt subtotal. The GST included in the fare is equal to:

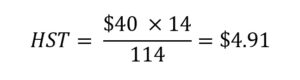

Alternatively, if the registrant

fares include the:

§ 13% HST, multiply the total by 13 and divide the result by 113.

§ 14% HST, multiply the total by 14 and divide the result by 114.

§ 15% HST, multiply the total by 15 and divide the result by 115.

Example 2

A taxi driver working in Nova Scotia charges a $40 fare for a trip from an airport to a hotel. No HST was shown after the receipt subtotal. The HST included in the fare is equal to:

3.1.2.

Invoice / Receipt

Presentation

When issuing a receipt, the

receipt must show the total GST/HST rate, or the total tax payable that applies

to the fare for the commercial ride-sharing services, and either of the

following:

§

the total amount paid or

payable for the service includes the GST/HST.

§ the amount of the GST/HST payable on the service separately from

the amount paid or payable for the service.

All ride sharing apps email the trip receipt or invoice to the riders after completing the trip. Drivers signed up with ride sharing services, therefore, need not to worry about receipt or invoice issuance and presentation.

3.2.

The GST/HST Paid

3.2.1.

GST/HST Paid on the

Purchase of the Vehicle

3.2.1.1.

When using the vehicle 90%

or more for ride sharing

Passenger vehicles that are

acquired, or imported, by registered individuals, or partnerships, are governed

by specific rules and restrictions under the ETA. Registered individuals, or

partnerships, are not permitted to claim full ITCs or ITRs at the time of

acquiring, or importing, a passenger vehicle unless the vehicle is intended for

use solely in commercial activities. For GST/HST registrants, excluding

financial institutions, the term "solely in commercial activities"

refers to a usage of 90% or more. Similarly, any tax owed regarding the

acquisition or importation of an enhancement to the vehicle is not eligible for

an ITC or ITR at the time of acquisition, or importation, unless the vehicle

itself will be utilized exclusively in commercial activities from the date of

its acquisition, or importation, until the date when taxes on the enhancement

became due.

In instances where a registrant

purchases or imports a vehicle intended for use as capital property and in

commercial activities, for the purpose of determining an ITC or ITR, the tax

owed on the vehicle is considered to be the lesser of the tax that is

actually due or an amount equivalent to the tax calculated based on the capital

cost limit that is applicable for income tax purposes under the Income Tax Act

or the Québec Taxation Act, depending on the situation.

In the CRA’s accounting terms, the capital cost allowance is the tax credit, or “allowance”, given in return to the depreciation expense, a.k.a. “cost”, resulting from using the capital property in production in commercial activities. The CRA dictates the depreciation expense method, the depreciation rate, and the maximum allowed allowance amount per year. The dictated depreciation method is the declining-balance method with different rate of depreciation for each asset class. CRA asset classes and their depreciation rates can be found in “Classes of depreciable property” in CRA T4002(E) Rev. 24.

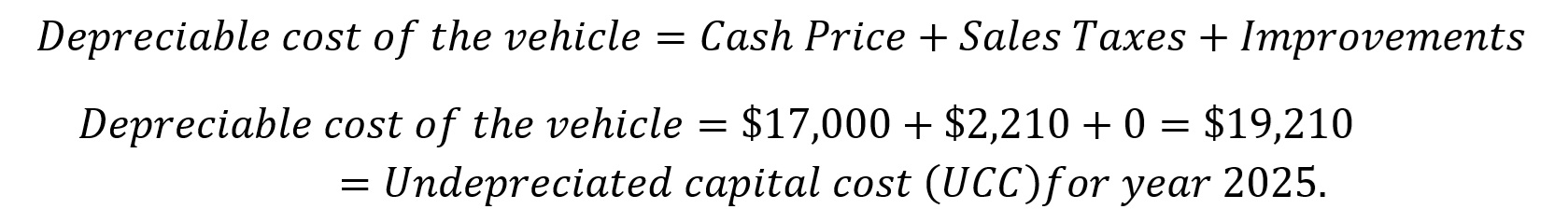

Example 3

A driver purchases a used vehicle

for $17,000 in Ontario in 2025 and pays 13% HST of $2,210. The vehicle is used

exclusively for commercial activities and is classified under class 10 by the

CRA under classes of depreciable property. The following are statements of

facts for this scenario:

§ The vehicle was available for use immediately.

§ The dictated rate by the CRA for the depreciation expense for

class 10 is 30%.

§ The half-year rule applies to this class of property.

The driver will be entitled to

claim the following ITC in 2025:

1. Calculate the depreciable cost of the vehicle:

2. Calculate the CCA for the year 2025:

The calculated CCA for the first year (2025) will be:

The lesser of the tax paid and the amount of the tax calculated based on the capital cost limit is the $2,210 HST paid. Therefore, all the $2,210 HST paid can be claimed as ITC in the 2025 GST/HST return.

3.2.1.2.

When using the vehicle less

than 90%, but more than 10%, for ride sharing business

In the case where the vehicle was used less than exclusively in commercial activities, the registered individual, or partnership, is eligible to claim an ITC or ITR on an annual basis, contingent upon its CCA claims for income tax purposes. The vehicle is considered to be acquired on the final day of each taxation year of the registrant following its acquisition, and an ITC or ITR may be claimed equivalent to: 5/105; 8/108 or 10/110 (where only the provincial component of HST was payable on the acquisition or importation); 13/113 or 14/114 or 15/115; or 9.975/109.975, respectively, off the portion of the CCA that was deducted in the calculation of income for that taxation year under the Income Tax Act or the Québec Taxation Act, as applicable, which pertains to commercial activities.

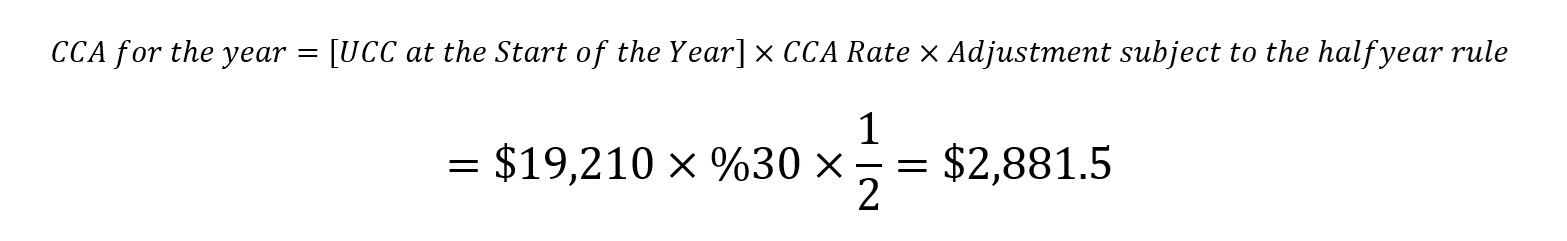

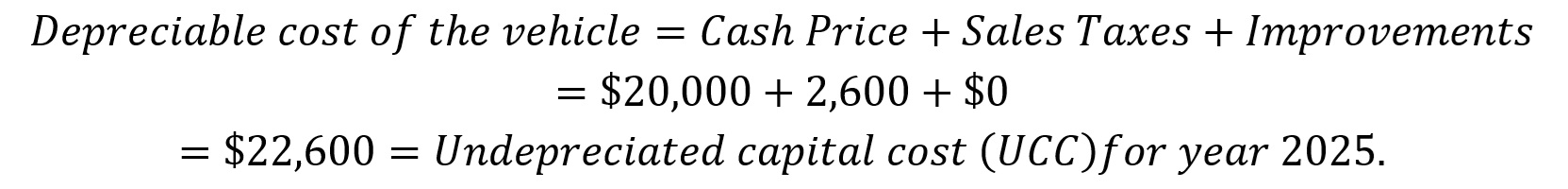

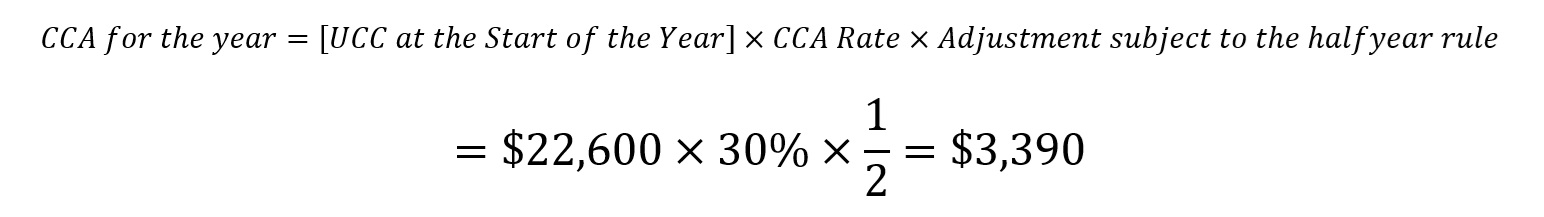

Example 4

A registrant driver purchases a

used 2019 vehicle in Ontario on May 1st, 2025, to work as ride

sharing service driver in Ontario. The driver has another job at a retail store

and will be using the vehicle 50% of the time for ride sharing business, i.e.

commercial activities, and 50% of the time for personal use, e.g. going to work

at the retail store or going to shopping. The following are statements of facts

for this scenario:

§ The vehicle was available for use immediately.

§ The sale invoice of the car showed a subtotal of $20,000 with no

additions or improvements made to the vehicle in the year 2025.

§ According to CRA “classes of depreciable property”, the vehicle

is classified as class 10.

§ The dictated rate by the CRA for the depreciation expense for

class 10 is 30%.

§ The half-year rule applies to this class of property.

The driver will be entitled to

claim the following ITC in 2025:

1. Calculate the depreciable cost of the vehicle:

2. Calculate CCA for the year

The lesser of the tax paid and the

amount of the tax calculated based on the capital cost limit is the $2,600 HST

paid. Therefore, all the $2,600 HST paid can be claimed as ITC in the 2025

GST/HST return.

The following table shows the CCA calculations for the first three years of the vehicle useful life:

|

Year |

Undepreciated capital cost (UCC) at the start of the year |

X |

CCA rate % |

X |

Adjustment subject to the half-year rule |

= |

CCA for the year |

|

2025 |

$22,600 |

X |

30% |

X |

50% |

= |

$3,390.00 |

|

2026 |

$19,210

(=$22,600-$3,390) |

X |

30% |

|

|

= |

$5,763.00 |

|

2027 |

$13,447 (=$19,210-$5,763) |

X |

30% |

|

|

= |

$4,034.10 |

– Table 1. CCA formulas and calculations. –

3.2.1.3.

When using the vehicle less

than 10% for ride sharing business

Drivers using their vehicle less than 10% of the time for ride sharing business are not eligible to claim ITCs on their paid GST/HST on the acquisition or importation of capital personal property of passenger vehicles.

3.2.2.

GST/HST Paid on Operating

Expenses

As a registrant, a driver can

generally claim an ITC to recover the GST/HST paid, or payable, on their

business purchases such as gas, car repairs, and car washes. Drivers must keep

records of the amounts they pay or owe to support their ITC claims upon an

audit. The ETA requires that a registrant obtain adequate supporting

documentation prior to claiming an input tax credit, to show that GST/HST has

been paid to a registered supplier. CRA GST/HST memorandum 8.4 “Documentary

Requirements for Claiming Input Tax Credits” provides more details on the documentary

requirements that registrants must satisfy to substantiate claims for ITCs.

The registered individual, or partnership, must be a registrant during the reporting period in which the GST/HST on the property or service became payable by the person, or was paid without having become payable. The ITC must also be claimed in a return filed by the due date within the time limit for claiming the ITC, which is four years from the date the GST/HST was paid, or became payable.

4. Change of Use of Personal Capital Property

If the GST/HST registered individual decides to stop working as a ride sharing driver (e.g. they have landed another paid job), there would be a change of use of the vehicle from exclusively for commercial activities to personal use. The treatment would be to deem the ride sharing business has closed, and the assets of the business were sold. Therefore, when stopping the ride sharing business, the registrant must value their vehicle in the market at the time of stopping the ride sharing business and calculate the HST collected upon sale of the vehicle, as if the vehicle was sold. The calculated HST collected would be reported on line 103 of the final GST/HST return of the registrant.

Example 5

A well-educated ride sharing

driver was able to land a paid manager job at Corporate A for $125,000

annually, plus bonuses, and will start their full-time job as an employee on

June 9, 2025. The driver decided to quite operating as a ride sharing driver and

their last day of ride sharing service delivery was May 31, 2025. The following

are statements of facts for this scenario:

§ The vehicle was used 90% of the time in commercial activities.

§ The place of supply for car purchase, sale, and ride sharing

services was Ontario.

§ The vehicle was purchased for $23,000 on January 1, 2025, and $2,990

was paid as HST.

§ The market value of their vehicle on May 31, 2025, was $19,000.

§ GST/HST returns were to be filed and paid annually on January 31

(i.e. ending period is December 31).

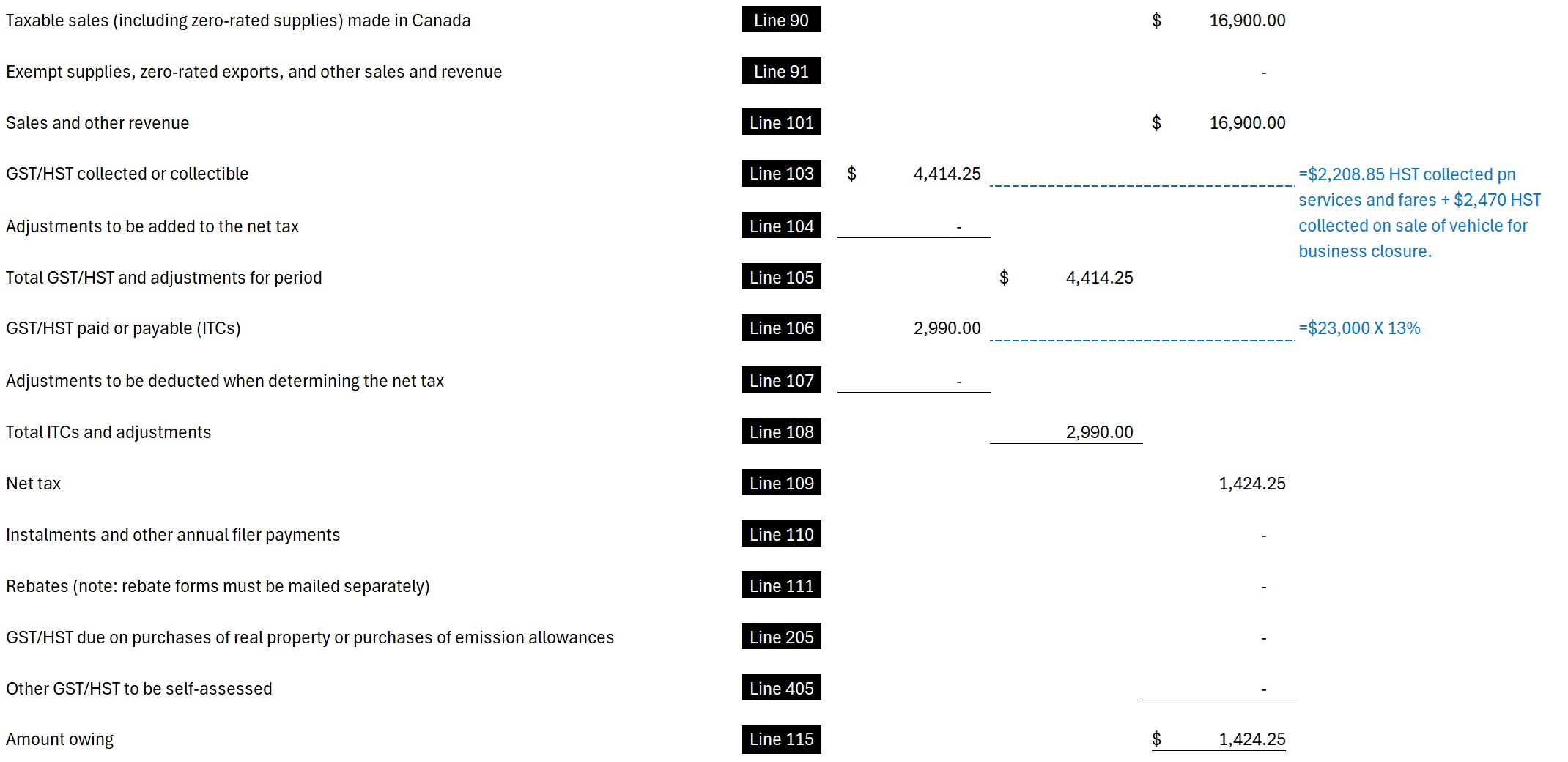

The filed GST/HST return on January 31, 2026, will be as follows:

– Figure 1. Final GST/HST Return –

|

Line 101 |

Is the total

amount of revenue from supplies of ride sharing services. This amount does

not include GST/HST, provincial sales taxes, or any revenue amount reported

in a previous return. |

|

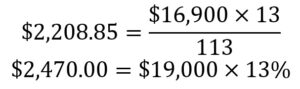

Line 103 |

Is the

GST/HST collected on supplies of ride sharing services discussed in section

3.1 in this article. The $4,414.25 is calculated as follows: =$2,208.85 HST collected on services and fares + $2,470 HST collected on sale of vehicle for business closure. |

|

Line 106 |

Is the eligible

ITCs for the GST/HST paid, or payable, on the value of property and services the

registrant acquired, imported, or brought for consumption, use, or supply in

the course of their commercial activities. |

|

Line 109 |

Is net tax, or the difference between tax collected and tax paid. |

|

5. Audits and Records Retention

The legislation imposes the

responsibility on registrants to file their GST/HST, or QST, returns with the

Minister of National Revenue in a specified manner, as well as to pay or remit

any amounts owed to the Receiver General. Furthermore, the Minister possesses

the discretionary power to register and allocate GST/HST or QST registration

numbers to persons who must register for GST/HST, or QST, and are not

registered.

Registered individual drivers must maintain adequate books and records, in English or French, to enable the determination of their tax liabilities and obligations. The CRA may demand information upon assessment or audit for the enforcement of the ETA.

6. Further Assistance or Information

For more information or inquiries kindly reach out to us at insights@dominionaudit.com.

CRA Reference Materials

CRA GST/HST memorandum 8.4 “Documentary

Requirements for Claiming Input Tax Credits” provides more details on the documentary

requirements that registrants must satisfy to substantiate claims for ITCs.

CRA Guide on Input Tax Credits “Calculate

input tax credits – ITC eligibility percentage”.

CRA guide RC4125 “Basic

GST/HST Information for Taxi and Limousine Drivers” gives more information

on GST/HST for self-employed taxi or limousine drivers in the taxi business.

Department of Finance Canada “2025

Automobile Limits” provides the 2025 automobile deduction limits and expense

benefit rates for businesses.

GST/HST Info Sheet GI-196 “GST/HST

and Commercial Ride-sharing Services” gives more information on the GST/HST

requirements for self-employed commercial ride-sharing drivers along with the

simplified GST/HST measures available to them based on the amendment to the

GST/HST definition of taxi business which received Royal Assent on June 22,

2017.

GST/HST memorandum 15.1 “General

Requirements for Books and Records” explains the requirements under the ETA

for registrants to retain and make available books and records, documents and

other information.

RC4022(E) Rev. 24 “General

Information for GST/HST Registrants” provides the meaning of “exclusively

in commercial activities”.

T4002(E) Rev. 24 “Self-employed

Business, Professional, Commission, Farming, and Fishing Income” gives more

information on capital cost allowance.